Lately, Micron Technology (NASDAQ:MU) has been in the headlines quite a lot and for very good reason. The company’s third-quarter results surpassed consensus estimates across the board by a solid margin. And now, chances of stellar performance in the fourth quarter remain strong, all thanks to increasing demand from data centers and gaming consoles, improving smartphone demand, favorable product mix, a well-diversified customer base, and a healthy balance sheet.

Despite a solid financial performance and broad product portfolio, I believe that the stock is significantly undervalued. Although the company has managed to rise 60.91% from its low of $31.13 in March 2020, it nevertheless remains down by 6.30% YTD. The market seems to not have adequately priced several secular tailwinds that can benefit the company in the next few years.

The current tech-enabled world requires a ton of memory and storage solutions

According to industry association, SEMI, there will be a 20% YoY growth in DRAM (Dynamic Random Access Memory) and NAND sales in 2021.

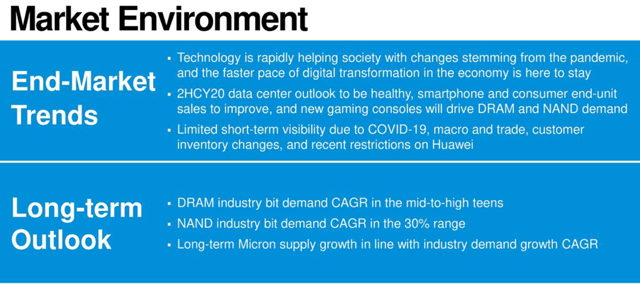

These numbers seem highly plausible in the current global economy. Today’s pandemic-driven world is increasingly relying on e-commerce and online activities such as gaming and video streaming. Going beyond work-from-home and study-from-home initiatives, there is also a huge demand for drone-based deliveries and other robotic applications. Government stimulus for the automotive sector will boost demand for electric vehicles in the next few quarters. Secular growth trends in areas such as cloud computing, 5G, AI, machine learning, IoT (Internet of Things), and edge computing are resulting in data explosion, which is in turn reflected in a huge spike in demand for enterprise cloud and networking services. Micron expects much of this demand to translate into a healthy uptake for memory and storage solutions by data centers in the second half of the calendar year 2020.

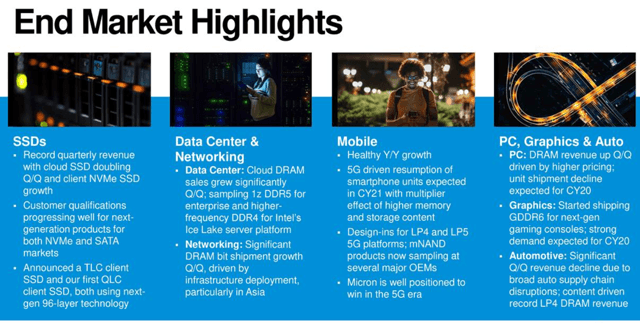

Micron is also seeing solid demand from gaming consoles in the remaining part of 2020. According to Barron’s, there are rumors about Sony (SNE) planning to manufacture next-generation PlayStation. Sony is expected to sell almost double the number of videogame consoles in 2020 owing to the pandemic. Although not a very big part of Micron’s business, these plans will nevertheless increase the company’s pricing power for memory and storage solutions.

While demand in mobile and PC is currently muted, the company expects this to recover gradually throughout 2020. 5G continues to be a solid tailwind, as even the cheapest 5G mobile phones require almost double the amount of DRAM and flash storage as compared to existing 4G phones. Demand from mobile manufacturers shifting to 5G phones is a big opportunity for Micron.

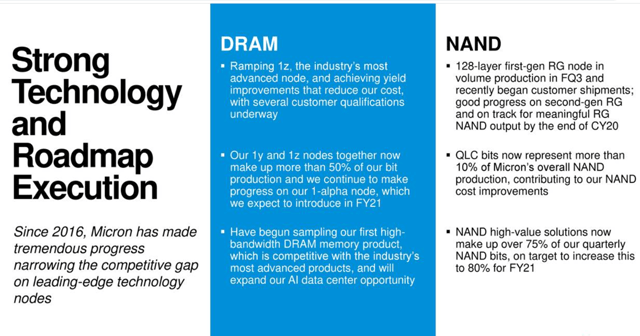

Micron is working on introducing cutting-edge innovations in memory and storage space

Micron has been working on introducing high-value innovations in DRAM and NAND space to improve product mix and reduce pricing impact associated with memory commoditization.

The company is working on advancing DRAM and NAND nodes to improve efficiency and reduce costs. The company is working on introducing a high-bandwidth DRAMs to further capture AI (artificial intelligence) data center opportunity.

Micron has also succeeded in dramatically increasing the percentage of high-value solutions in its NAND business. The company aims to increase the share of high-value solutions in its NAND bits from the current 75% to 80% in fiscal 2021.

Currently, 3D QLC (Quad-level cell) makes up almost 10% of the company’s total NAND production. The company is targeting PC OEMs (original equipment manufacturers) and providers of read-intensive applications for QLC technology. Since this technology can store four bits per cell, even higher than the three bits stored by the current cutting-edge TLC (triple-level cell) technology, Micron can eventually save costs and improve overall profitability.

Micron is also introducing NVMe products in its SSD portfolio to further target clients as well as data center markets. The company is also retaining leadership in the SATA SSD market. The company has been gradually capturing market share in the SSD market, all thanks to the continuous stream of innovations.

The company has reported robust financial performance in the third quarter

Micron Technology commenced the tech earnings season with a bang. In its third quarter, the company’s revenues jumped 13.58% YoY to $5.44 billion, ahead of the consensus by $128.18 million. The company’s non-GAAP EPS of $0.82 is also ahead of the consensus by $0.06.

The above diagram shows Micron’s third-quarter performance across various end markets. The company’s DRAM revenues grew 16% sequentially and 6% YoY, while NAND revenues grew 10% sequentially and 50% YoY. The company also managed to continue operations at its fabrication and assembly sites with minimal disruptions even during the pandemic. All these are commendable achievements, especially in these difficult times.

Micron Technology has come out with a solid outlook for the fourth quarter. The company expects revenues in the range of $5.75 billion – $6.25 billion, much higher than the consensus estimate of $5.5 billion. The company has also guided for gross margin in the range of 34% – 36% and operating expenses in the range of $825 million – $875 million, and non-GAAP EPS in the range of $0.95 – $1.15.

In the last 10 years, Micron’s average ROA (return on assets) has been around 9.7%, ROE (return on equity) close to 16%, ROIC (return on invested capital) of 13%, and ROCE (return on capital employed) of 13%. The ROIC and ROCE are more relevant for a capex-intensive Micron. These are significantly above the overall market average for these metrics, which is around 8% for both the cases.

Investors should consider these risks

Memory and storage is a cyclical business, and it is only obvious that investors will remain concerned about Micron Technology during this ongoing recession. Micron has also highlighted the reduced analyst estimates for sales of automobiles, smartphones, and PCs for fiscal 2020 as compared to the pre-COVID-19 levels. This is despite the increased demand for enterprise laptops and Chromebooks.

However, we need to remember the tech industry has been one of the major white knights in this recession. The pace of technological development is also much more accelerated today. Hence, although there remains considerable short-term uncertainty for Micron Technology, the long-term prospects seem healthy for this leading memory and storage player.

The automotive sector is also facing a significant decline in end-consumer demand. The impact was mostly felt in Micron Technology’s embedded business in the third quarter. Semiconductor players focused on trends such as electrification of vehicles and automotive digitization initiatives such as ADAS (advanced driver assistant systems), infotainment, and safety, are also feeling the heat. Micron Technology is managing this headwind by reducing DRAM utilization levels to align with the reduced demand. Under-utilization at the company’s Lehi fab resulted in a negative revenue impact of $155 million in the third quarter. Micron Technology expects the fourth-quarter impact of under-utilization to be $135 million. This impact will gradually reduce as the global economy revives in 2021.

Analysts have started highlighting the possibility of increased inventory stocking behavior by many technology companies. This can result in significant top-line and bottom-line volatility in the coming quarters. While Micron Technology has not refuted this possibility, the company remains fairly confident of healthy inventory levels in the data center market. Micron, however, points out at inventory buildup by mobile phone customers as a way to reduce supply chain risk.

Investors are also worried about the increasing commoditization of memory. The relatively low brand power, switching costs, and network effect for memory and storage offerings make the business especially vulnerable to price wars. Cleveland Research analyst, Chandler Converse, also anticipates weaker pricing for server DRAM business in the second half of the calendar year 2020. While tighter supply and a huge spike in demand may offset the pricing impacts in the short run, it will continue to be a challenge for the entire memory business in the long run. Micron Technology, however, has found a way to offset some of this impact by offering high-value solutions and continually improving its product mix.

The memory and storage business is capital-intensive and requires significant capital, not only for innovation but also for maintenance. In the third quarter, Micron’s capital spending was $1.9 billion, while cash from operations came at around $2.0 billion. Although cash flow from operations was a healthy 37% of the company’s revenues, it is still almost equal to the capex spending. Micron expects its fiscal 2020 capex to be $8.0 billion. A major chunk of this is the construction capex. Here, the company aims to reduce front-end equipment capex in DRAM and NAND space by 40% YoY. This move is expected to reduce the bit supply in the fourth quarter. However, the company expects some of the cutback expenses to increase in fiscal 2021.

While high capex remains a big challenge, it also affords certain protections to existing players. Suppliers have also highlighted difficulties in delivering certain equipment. The entry barriers in terms of capex and sourcing of rare earth metals as raw materials that are available only in certain parts of the world have helped limit competition in this segment.

Finally, geopolitical risks and increasing U.S. – China trade tensions continue to be a sore point for the entire semiconductor industry, and Micron is no exception. The U.S. government’s restrictions on supplying ASICs to Huawei have caused widespread disruptions across the semiconductor industry. Although Micron Technology has licenses to ship standard products for Huawei’s mobile and server business, the company remains exposed to changes in supply chain disruptions in the industry.

What price is right here?

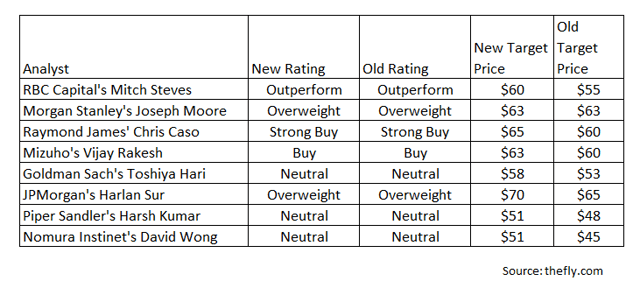

According to finviz, the 12-month consensus target price for the company is $65.11. The company is trading at PB multiple of 1.47x, PS multiple of 2.89x, and forward PE multiple of 10.62x. These valuation multiples are quite low when we consider the exploding demand for DRAM, NAND, and 3D XPoint technologies in today’s tech-enabled global economy.

The robust product portfolio, solid balance sheet, and secular industry trends are big positives for Micron Technology. In this backdrop, I believe that the consensus target is a fair reflection of the company’s growth prospects in the next 12 months.

Many analysts have upgraded the company’s rating and increased target prices.

Although there remain many challenges for the memory business, Micron seems well-positioned to weather most of them. The company’s current ratio is around 2.90x, which implies that current assets are more than sufficient to satisfy any immediate liabilities. The company had total cash worth $9.3 billion, total liquidity worth $11.8 billion, and total debt of $6.7 billion at the end of the third quarter. Micron does not seem to be facing any immediate challenges in repaying debt.

Micron does not pay any dividends. However, the company returned $40 million in the third quarter and $134 million in the first nine months of fiscal 2020 to shareholders in the form of share repurchases. Repurchases are a more effective way of returning shareholder value, considering that dividends are taxed twice.

In this backdrop, I feel that Micron Technology can prove to be an attractive pick for retail investors with a penchant for technology stocks and with above-average risk appetite. However, investors will need to hold on to the stock at least for 12 months to reap the benefits of investing in Micron.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.